You may have noticed some interesting developments if you’ve been closely monitoring the UK mortgage rates. Even though the Bank of England has recently increased rates, the average mortgage rates have been steadily declining.

Looking back to December 2021, mortgage rates climbed significantly when the Bank of England began to raise the base rate to around 2.34%. Today, the same product comes with an average rate of 6.76%, which is quite a jump.

However, what’s really interesting is that despite a suggested forecasted rate of 5.75% in 2024, up from its current 5.25% rate, quite a few lenders have been reducing their rates since the start of August this year. A few have even cut their two and five-year fixed rates roughly between 0.5% and 0.75%.

So, this further leads us to ask: Will other lenders follow suit, and can we look forward to further reductions in mortgage rates to come?

Trimming the fat

So, given the recent interest rate hikes, why are some lenders cutting their rates at what seems like a counter-intuitive move?

In general, lenders will adjust their mortgage product prices in accordance with the Bank of England’s rates. These adjustments are based on various factors such as gilt yields (the rate of government borrowing) and swap rates. The fall in these money markets has spurred investors to believe that the brakes are being applied to the BoE rate increases.

This, coupled with the housing market slowing down as homeowners battle to keep up with repayments and high mortgage rates, turns potential buyers off from getting on the property ladder, to begin with. In an effort to attract customers, lenders may cut their rates to get them in the door.

Industry lending giants Halifax, NatWest, Barclays Bank and others have all made notable cuts to their fixed-rate products.

Henry Jordan, Director of Home at Nationwide Building Society, explains this by saying, “These latest changes build on the reductions we made last week for existing customers. With swap rates having fallen from their early July peak and stabilised somewhat, we are now able to reduce rates for new customers.”

What do the latest UK mortgage rates look like, and will they continue to decline in 2023?

Even though the current rate of inflation is on a downward trend, the Bank of England is concerned with the current rate of inflation – 6.4% for July 2023.

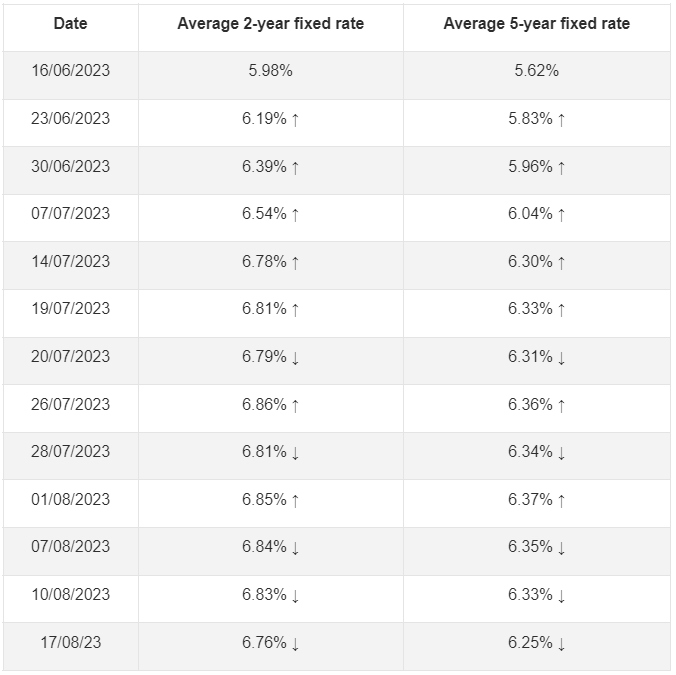

As of August, average mortgage rates were as follows:

- Two-year fixed deal: 6.76%

- Five-year fixed deal: 6:24%

- Standard variable rate (SVR): 7.85%

The last time the average two-year fixed rate significantly exceeded the typical five-year rate was back in 2008.

Rates have rapidly climbed in recent months, as displayed here and according to Moneyfacts:

Should I take out a mortgage?

Given this information, the burning question is, should borrowers commit to a long-term fixed-rate deal? The decision becomes even more treacherous when we consider the current landscape where the two-year fixed rate isn’t much higher than the typical five-year rate. Although the interest rates on the average five-year and ten-year fixed rates remain comparatively high, what happens when interest rates decrease – and you’re tied into a lengthy loan period?

Given these complex criteria, it’s wise to consider talking with a reputable adviser, especially if you’re unsure about the best course of action.

Choice Mortgages will provide you with independent mortgage advice from decades of industry experience. Our friendly and professional team will help you to choose the best Mortgage route for your personal needs. Whether you are a first-time buyer, looking to remortgage your home, or your deal is coming to an end, we are here and ready to assist you in person.