What was the Help to Buy scheme?

The Help to Buy scheme, which played a significant role in helping individuals and families step onto the property ladder, has now concluded. The government-backed initiative supported first-time buyers and existing homeowners in purchasing a new-build property with a small deposit. It provided an equity loan from the government, allowing buyers to contribute a minimum deposit of 5% of the property value. However, the scheme no longer accepts new applications.

So what are your options for purchasing a home?

Alternatives to Help to Buy Mortgages

While the Help to Buy scheme has ended, alternative options are still available to purchase a home.

Shared Ownership

This scheme allows you to purchase a share of a property (typically 25% to 75%) and pay rent on the remaining portion. It can be a more affordable way to step onto the property ladder, especially if you have a limited deposit.

Discounted Market Sale

Under this scheme, properties are sold at a discounted price, typically 20% below market value, to individuals who meet specific criteria, such as being a key worker or living in a specific area.

Right to Buy

This scheme allows you to purchase your rented home at a discounted price. It offers eligible tenants the chance to become homeowners and secure the property they have been living in.

Forces Help to Buy

This scheme specifically caters to armed forces personnel, providing an equity loan of up to 50% of their salary (maximum £25,000) to assist with buying their first home or moving to a new one.

Rent to Buy

Rent to Buy schemes allow you to rent a property at a reduced rate for a fixed period, usually around 5 years. During this time, you can save for a deposit, to transition into homeownership at the end of the rental period.

Did you know?

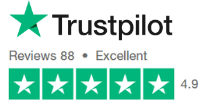

Although the Help to Buy scheme has concluded, our team can still assist you. We're here to help you navigate the process of repaying your equity loan and achieving your home ownership goals.

Contact UsNot sure what mortgage you need or qualify for?

Whether you're navigating the aftermath of the Help to Buy scheme or exploring alternative routes to home ownership, contact us today to embark on your journey towards owning your dream home.

Contact Us