What is a Remortgage?

Remortgaging means moving your mortgage to a new lender while staying in the same property.

It is important to understand your existing lenders terms and any options that might be available with them, so we can compare these to the remortgage options.

There are various reasons why you might choose to remortgage;

- Switch to a lower interest rate and save money

- Borrow more money for home improvements

- Consider consolidating other debts

- Want to reduce the term

- Want to make a significant reduction to the balance

- Need to transfer equity following a separation from a joint partner

We would discuss all your requirements before recommending what is right for you.

Is remortgaging right for you?

Reasons against

- Had credit problems since taking out your last mortgage

- Already on a competitive rate

- You have very little equity

- Your property value has dropped

- Your financial circumstances have changed and may not be in employment or recently self-employed

- Early repayment charge is large

- Your mortgage debt is really small

Reasons for

- Your current deal is about to end and you want a better rate

- You want to borrow more money

- You're worried about interest rates going up

- You want to overpay, and your existing lender will not allow it

- You want to help your children on to the property ladder

- You have separated or met someone and want to transfer equity

- Your property value has increased, and you can review the product range available

How we can help

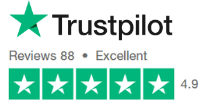

Whatever your requirements, we can help you remortgage. Whether you are local or further afield, we have helped thousands of clients throughout the UK. You may have used us in the past, you may have been recommended to us by a friend, or you may be using us for the first time. You might think a remortgage is not possible, but don’t let it be daunting.

Don’t waste time speaking to different lenders, when we are specialists. We understand the lending criteria and have access to the whole market. After the initial free consultation, we will understand your circumstances and we will have ensured that your existing lender options have been considered. Let us take the hassle away and provide a tailor-made solution. Don’t let busy lives get in the way of you finding a remortgage that is right for you.

Get remortgage advice

Your local independent mortgage experts

- We have an unbiased view of the whole mortgage marketplace

- We will compare your existing lender options to all other lenders in the market

- You don’t need to waste time chasing the progress of your application, we do that for you

Call us on 01780 480600

Speak to an adviserThe Cox Family

When we were looking to remortgage our house we went back to Choice Mortgages because Tony helped us with our first mortgage. Rob looked into our options and advised us on our choices. Working with us, Rob really made it easy and understandable and we wouldn’t go anywhere else if we ever needed their services again. Thanks for your help Rob - we always highly recommend you and Choice Mortgages.

You made it easy and understandable and we wouldn’t go anywhere else

We can help your find your perfect mortgage

Our mortgage brokers have an unbiased view of the whole market

Based in Stamford, Lincolnshire

Providing mortgage and insurance advice nationwide.

Choice Mortgages is an independent mortgage broker; having access to thousands of mortgage and protection products on the market. Our office has been located in Stamford for over 20 years and we have a team of professional advisers with a vast amount of experience.

Locally we are a short distance from Peterborough, Oakham, Oundle and Spalding.

We offer a free no obligation consultation and help you find the most suitable solution. Understanding lenders criteria and how you are eligible for a mortgage is paramount.

We provide a dedicated personal service and work closely with you every step of the way; organising the paperwork and taking care of the entire application process, making the transaction far less stressful for you. We know lives are busy and we can alleviate the time pressure, by offering telephone or face-to-face appointments.

About Choice Mortgages