It’s downright dizzying in these complex times, even when making relatively small choices like where to plan your next weekend trip or even important ones like making time to update your insurance provider. Never mind the mammoth task of deciding which mortgage is right for you.

You might be a first-time buyer scouting the market for the step onto the property ladder, moving or relocating to a new region, or someone who’s reviewing their mortgage. Chances are, the prospect is daunting, as this is one of the most significant life decisions ever made.

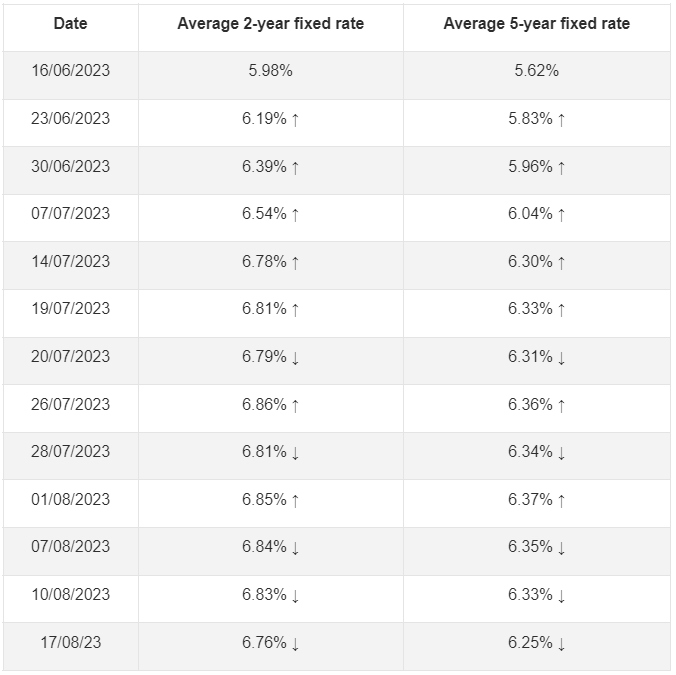

We’re here to shed some light and guide you on what is arguably the foundation of your property investment: the fixed-rate versus tracker mortgage decision. To indicate how volatile the climate is, there have been 14 interest rate hikes since December 2021, when the cost of borrowing was at an all-time low of 0.1%, compared to the current level of 5.25%, simply adding to uncertain times.

What is a fixed-rate mortgage?

A fixed-rate mortgage typically has these four characteristics.

- The interest rate will not change for a specific product period. So whether it’s over two, three, five or 10 years, the amount due each month will remain the same.

- Each monthly repayment is predictable. This can be of great help, especially with budgeting and the current rate of inflation and interest rate hikes.

- The borrower is protected against rate rises within the period.

- Overall, when compared to other loans, the total cost of the loan could be higher depending on other options available and subject to an early repayment fee should you opt to move to a different loan.

Whilst a fixed-rate mortgage may feel like more of a commitment, its certainty makes it an attractive option for those wanting peace of mind.

What is a tracker mortgage?

Unlike a fixed-rate mortgage, these types of loans feature a moving interest rate.

Typically, a tracker mortgage will follow the Bank of England’s (BoE) base rate, which is the interest rate at which high-street banks borrow money. So, if the BoE sets a rate that goes up or down, your tracker rate will reflect that change, plus or minus the percentage rate specified. The Monetary Policy Committee sets the rate and typically meet eight times each year (about every six weeks).

For example, you might be presented with a base rate plus 1.5%. This means that if, at that time, the base rate is 5.5%, your monthly repayment will be 7%.

To summarise tracker mortgages:

- If the interest rate changes, the repayment amount will also change.

- The borrower assumes this risk if interest rates increase.

- Unlike a variable mortgage, a tracker mortgage is bound to an external rate, which your lender must follow – this may mean that a tracker mortgage is more affordable than a variable mortgage.

The base rate is at a 15-year high currently. However, should rates fall, you might not benefit if your tracker has a “collar” of “floor” option.

Why you should choose a mortgage broker to help

Mortgage brokers are professionals who help find and organise the best loans to purchase residential properties. Unlike loan processors who represent banks and other lending institutions, brokers work on behalf of the borrower. Brokers are problem-solvers and look out for the consumer’s best interests, not those of the lenders.

At Choice Mortgages, we’ll help you find the perfect mortgage. We won’t:

- Charge you for a consultation.

- Insist on face-to-face meetings.

- Have a limited choice of lenders or work from a panel.

- Leave you hanging for answers, updates or appointments.

But we will give you a free, no-obligation consultation over the phone or in person at our office. We will also respond to any queries via email. As an independent mortgage (and insurance) broker, we have access to any lender, which means we’ll find the best product for you. And because our team of advisors are highly experienced, we can handle complex arrangements and straightforward queries.

Contact us today – we can typically arrange a same-day consultation and answer queries immediately. Because we use the latest technology, we can easily keep you in the loop with your query so you always know where you stand.